Fill in Your Michigan 1028 Form

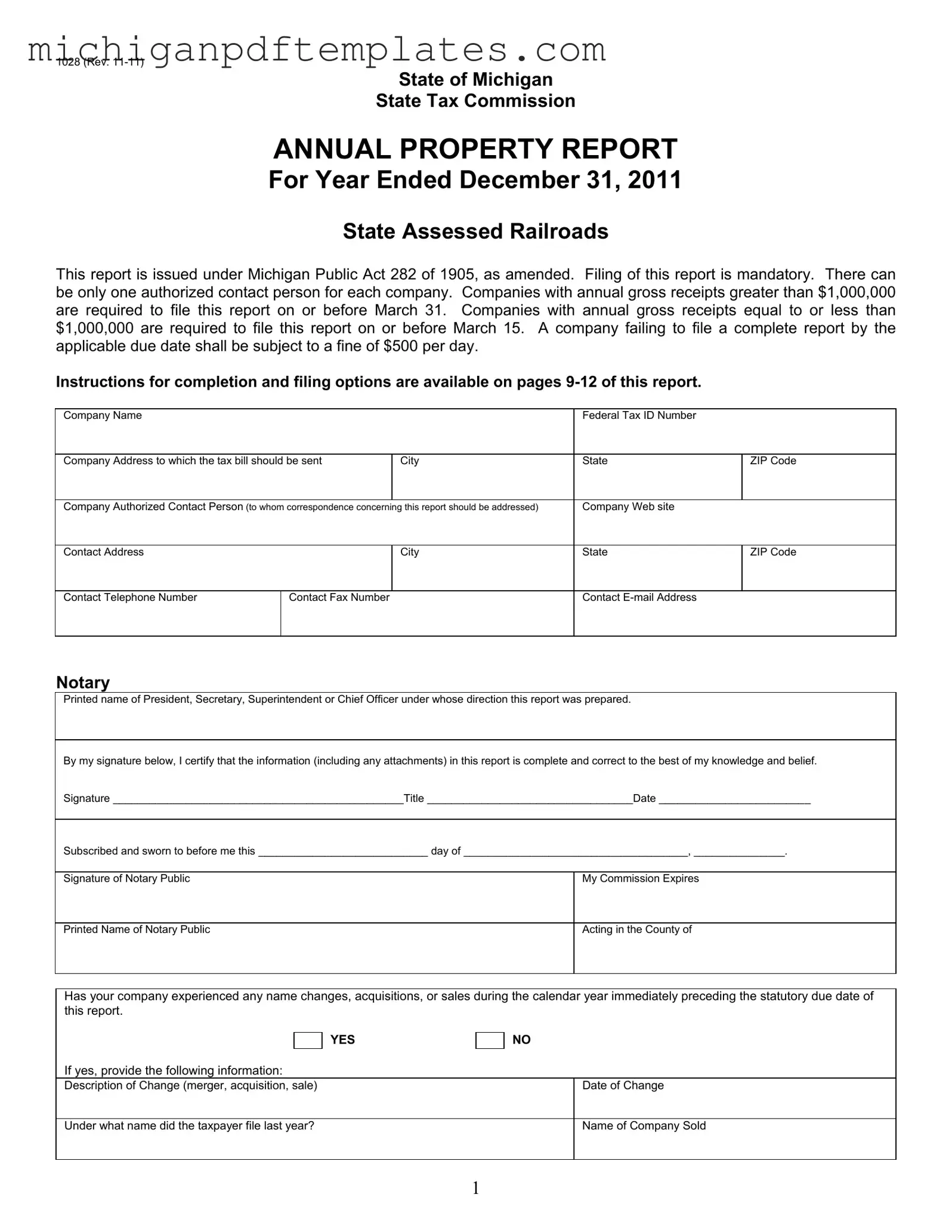

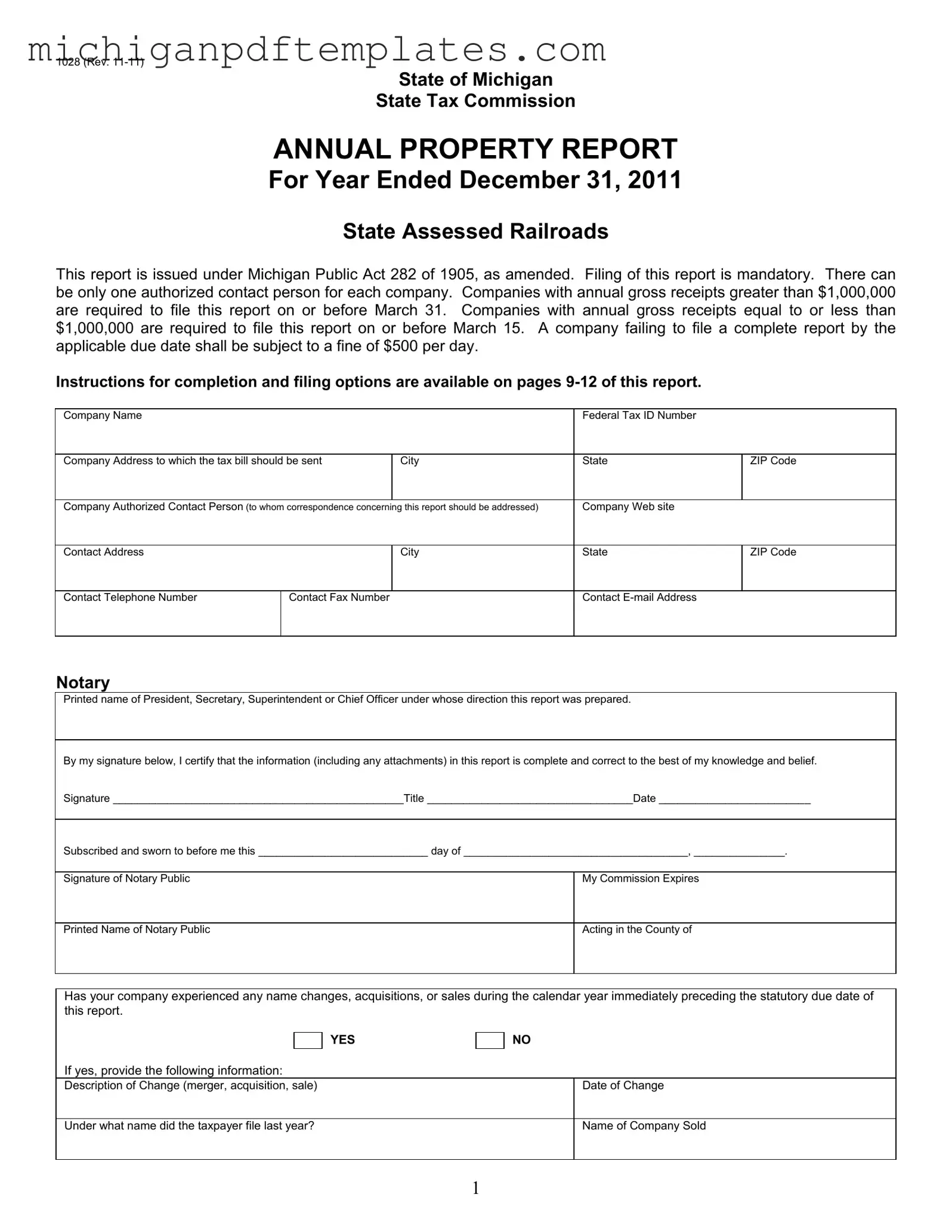

The Michigan 1028 form is an Annual Property Report specifically designed for state-assessed railroads. This report is mandated under Michigan law and must be filed by companies based on their annual gross receipts. Timely submission of this form is crucial, as failure to comply can result in significant fines.

To ensure your compliance and avoid penalties, fill out the Michigan 1028 form by clicking the button below.

Get Your Form Now

Fill in Your Michigan 1028 Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete Michigan 1028 online quickly.