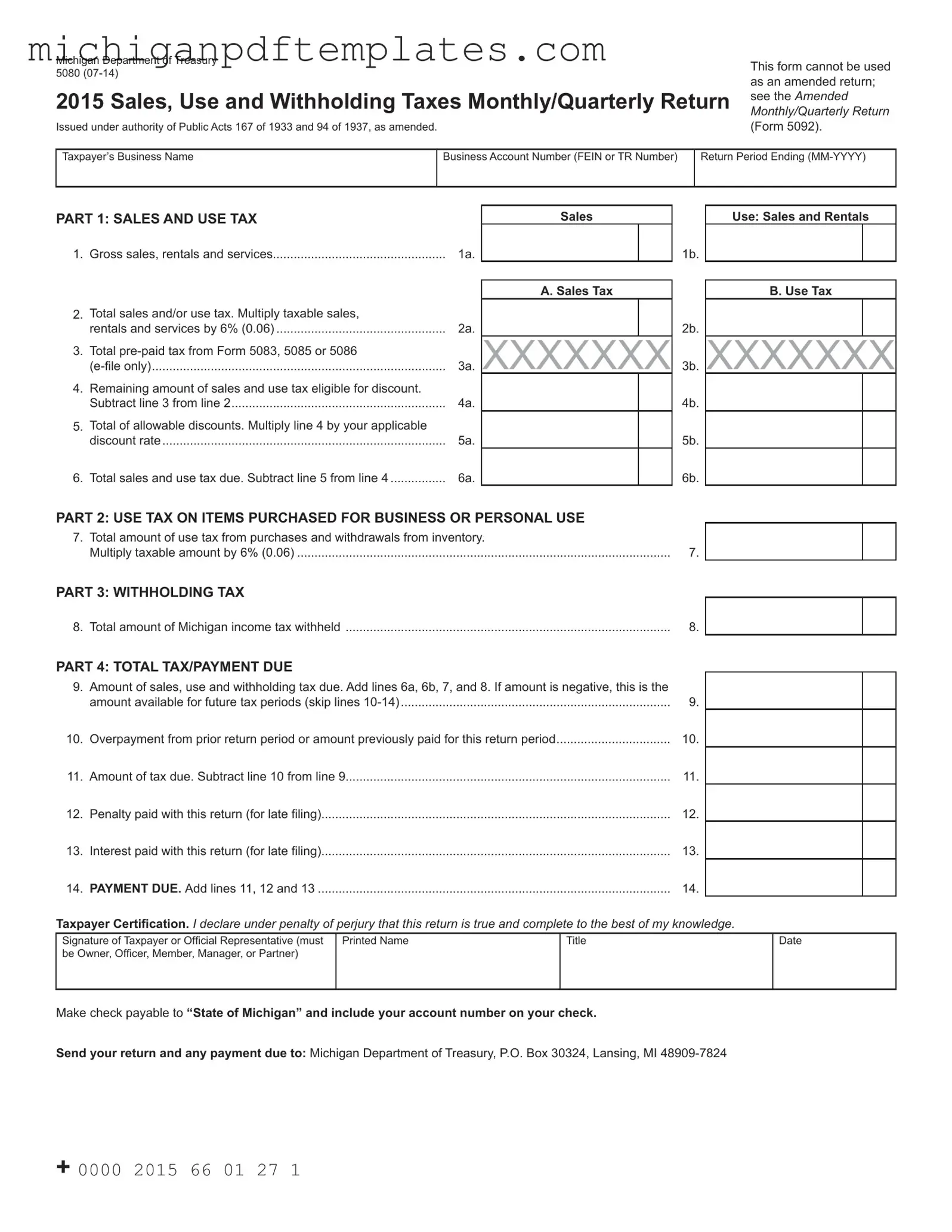

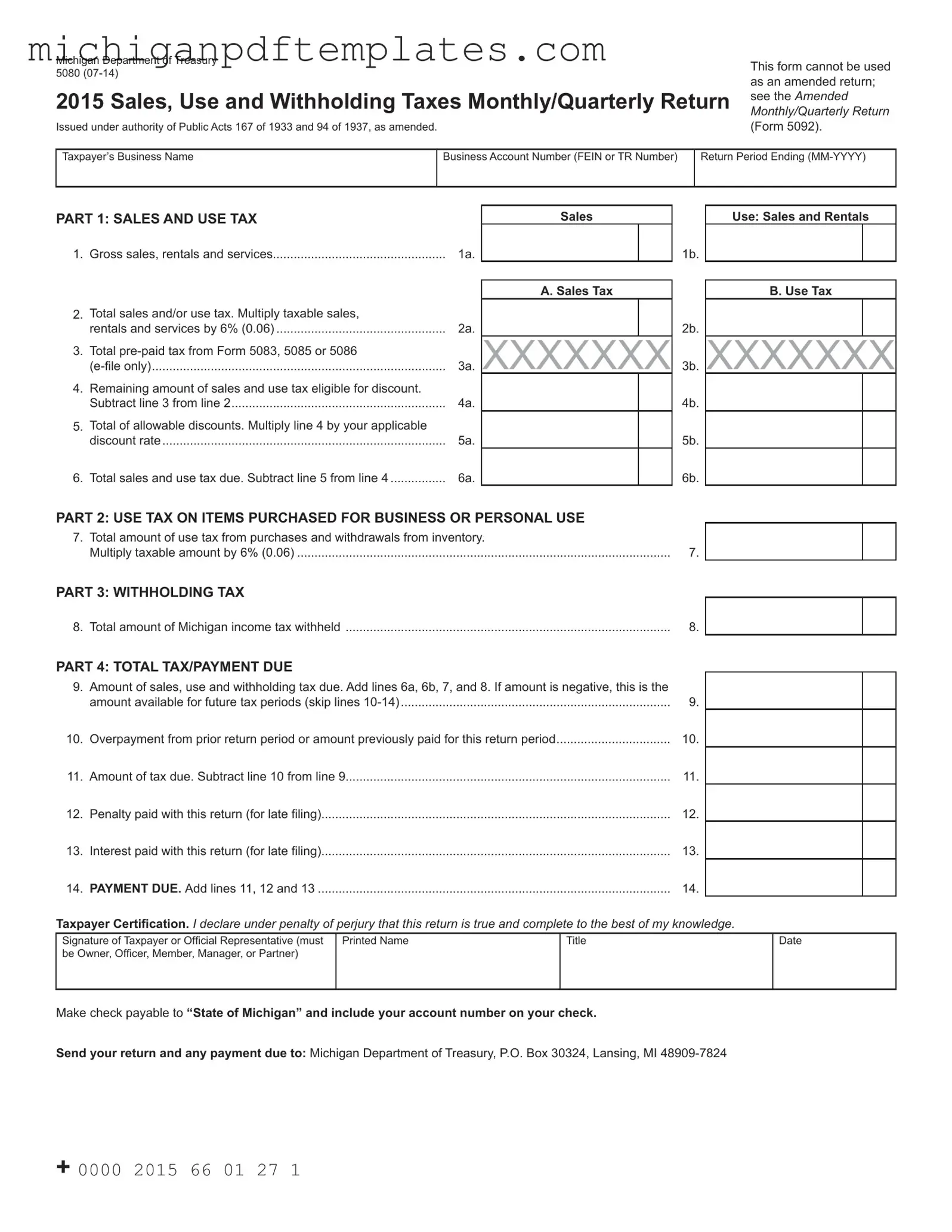

Fill in Your 5080 Michigan Form

The 5080 Michigan form is a tax return document used for reporting sales, use, and withholding taxes in the state of Michigan. This form must be completed accurately to ensure compliance with state tax laws and to avoid penalties. Understanding the details of this form is essential for taxpayers to fulfill their obligations effectively.

For assistance in filling out the form, please click the button below.

Get Your Form Now

Fill in Your 5080 Michigan Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete 5080 Michigan online quickly.