Fill in Your 447 Michigan Form

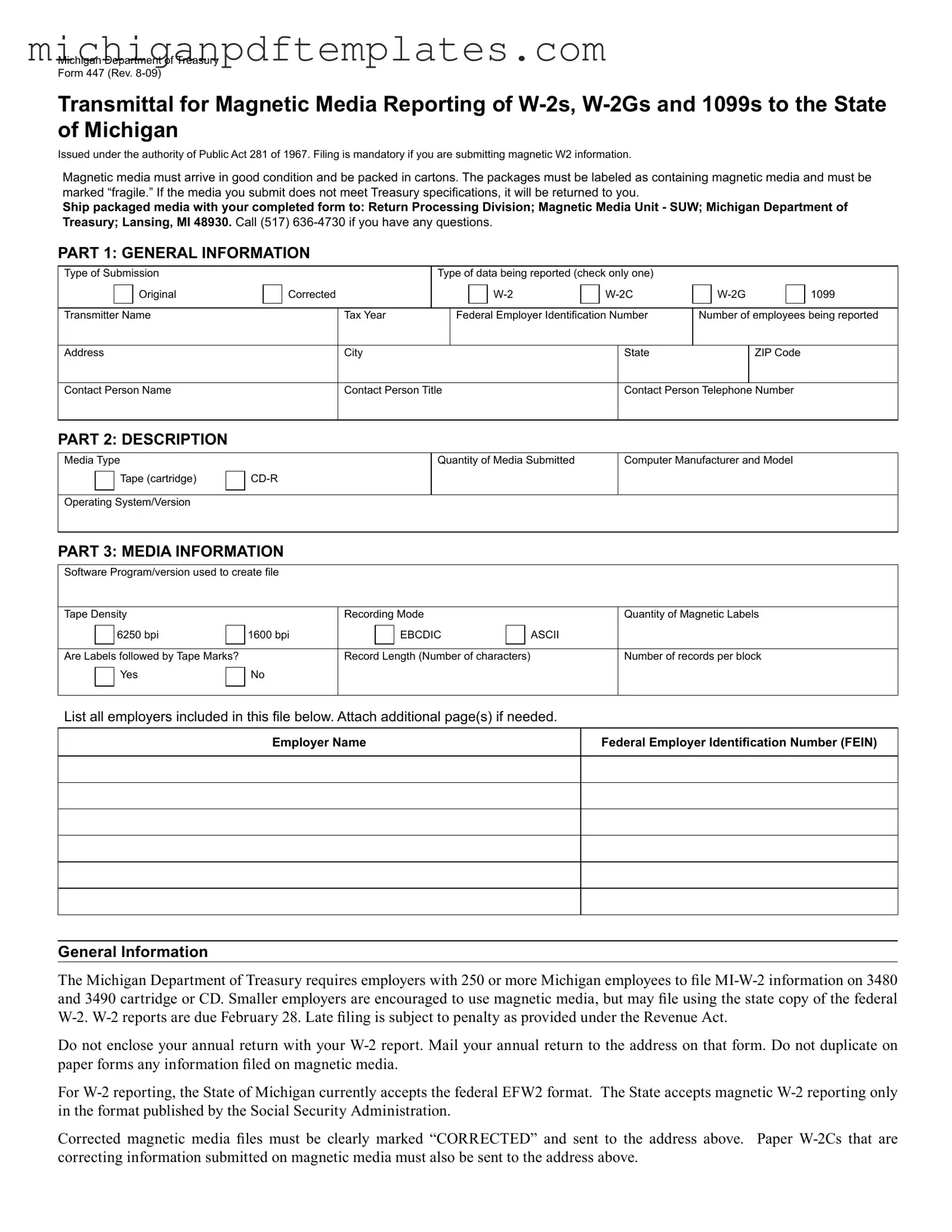

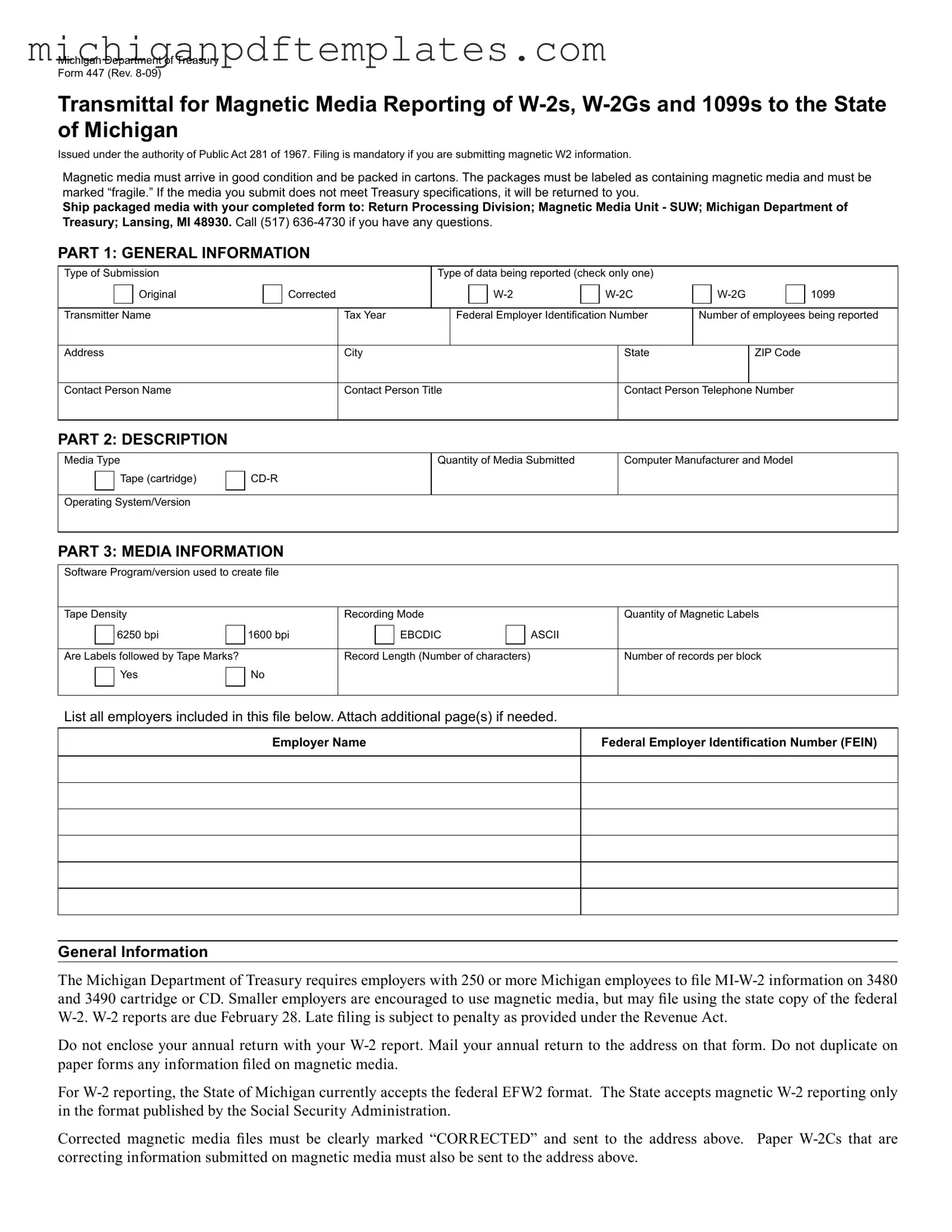

The Michigan Department of Treasury Form 447 serves as the transmittal document for submitting magnetic media reports of W-2s, W-2Gs, and 1099s to the State of Michigan. This form is essential for employers, especially those with 250 or more employees, as it ensures compliance with state regulations regarding the electronic filing of wage and tax information. To get started on your filing, click the button below.

Get Your Form Now

Fill in Your 447 Michigan Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete 447 Michigan online quickly.