Fill in Your 3636A Michigan Form

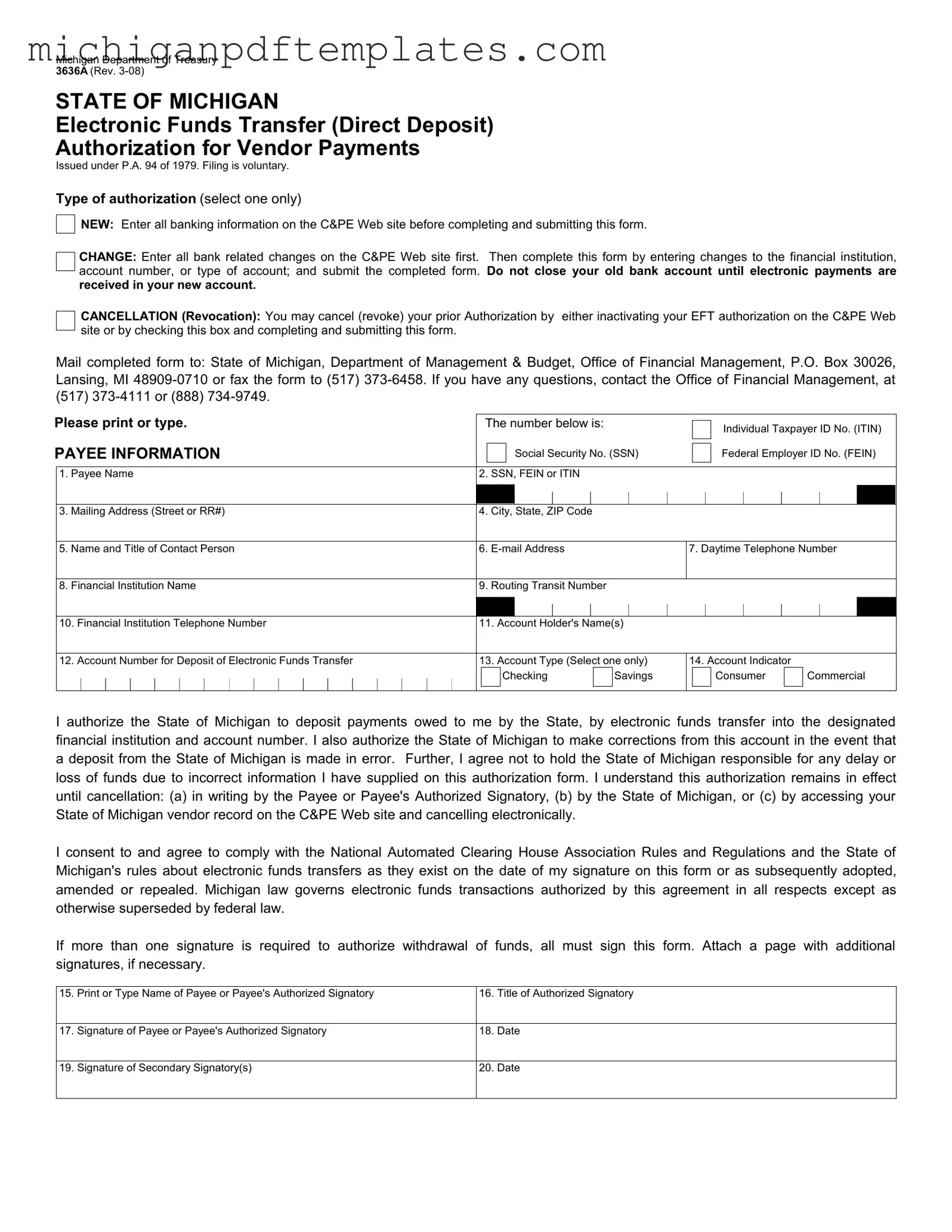

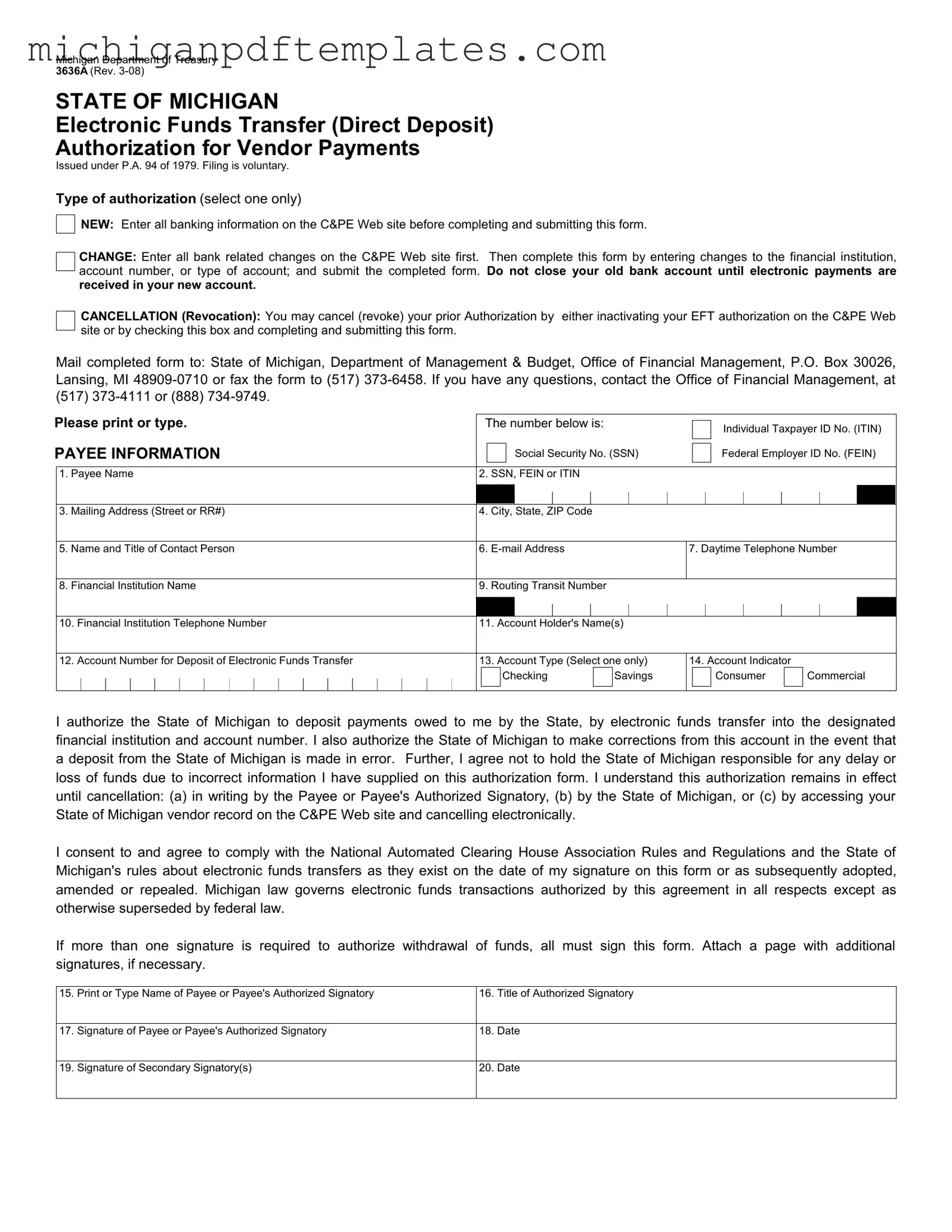

The Michigan Department of Treasury 3636A form is an Electronic Funds Transfer (Direct Deposit) Authorization used for vendor payments in Michigan. This voluntary form allows payees to authorize the state to deposit payments directly into their bank accounts. Understanding its purpose and proper completion is essential for ensuring timely and accurate payments.

Ready to fill out the form? Click the button below!

Get Your Form Now

Fill in Your 3636A Michigan Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete 3636A Michigan online quickly.