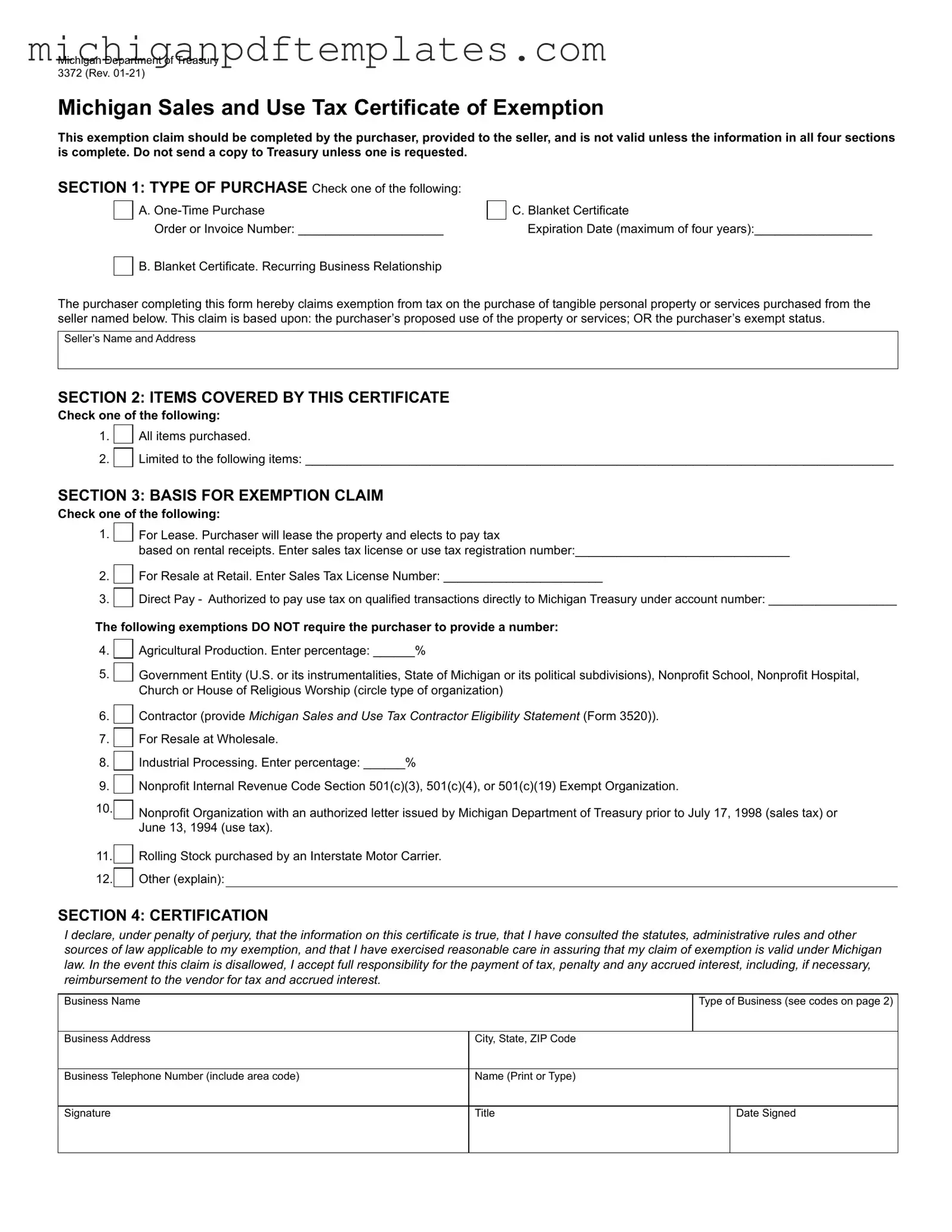

Fill in Your 3372 Michigan Form

The Michigan Department of Treasury 3372 form is a Sales and Use Tax Certificate of Exemption. This form allows purchasers to claim exemption from sales and use tax on eligible transactions. To ensure validity, all four sections must be completed and provided to the seller; no copy should be sent to the Treasury unless requested.

If you need to fill out this form, please click the button below.

Get Your Form Now

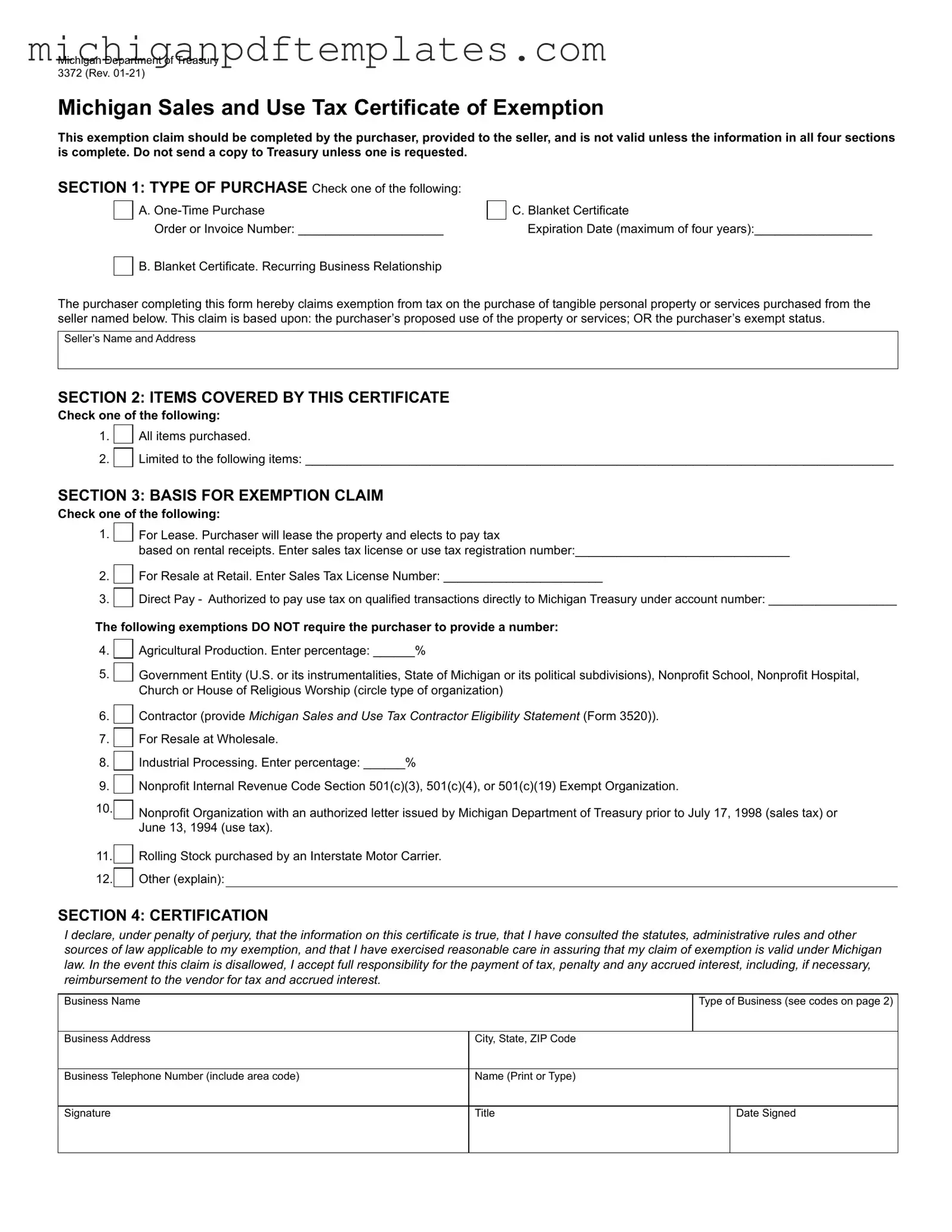

Fill in Your 3372 Michigan Form

Get Your Form Now

Get Your Form Now

or

▼ PDF Form

Finish this form quickly and move on

Fill in and complete 3372 Michigan online quickly.